Lightspeed FSG just released a new study on mobile banking in the U.S., based on a nationwide survey of nearly 2,500 consumers who own a smartphone or tablet. While most people realize that Millennials are the heaviest owners and users of smartphones in general, it is fascinating to discover that once the playing field is leveled to include only people who own a smartphone or tablet, Millennials are still by far the most likely group to engage with their bank or credit union using mobile banking.

Highlights from the Lightspeed FSG report show that:

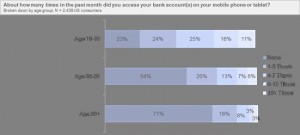

- There is a huge difference in mobile banking usage between age groups. Among 18-35 year-olds, 77% have used mobile banking in the past month, compared to only 29% who are 56+ years old. Those who are 18-35 are also much more likely to use mobile banking several times per month.

- Among customers of the largest banks, Citibank’s customers are the most likely to conduct mobile banking through the bank’s website (55%), whereas USAA’s customers are the most likely to use an app from the bank (67%).

- One-third (33%) of consumers received at least one mobile banking marketing message from their bank in the past few months. Of that group, over one-third (36%) said that the marketing message(s) they received made them more likely to use mobile banking services with their bank.

- Nearly half (46%) of mobile banking users consider mobile banking services to be ‘extremely important’.