This article was first published by Admap Magazine in August 2019

A “selfie” can now open a bank account.

In some places, anyway. In June, Natwest, part of the Royal Bank of Scotland, became the first major UK bank

to allow customers to quickly open a new bank account – without visiting a bank branch – by uploading

documents and submitting a selfie on their mobile device. This continues a trend set by several banks in other

regions, including the Philippines and South Africa. In the United States, reports of the advent of “selfie banking”

were abundant in 2016 and 2017, but so far it is not an option.

Of course, selfie banking is not the only way banks are pushing mobile. Many banks have rolled out remote

check deposit functionality, which allows customers to make deposits by using their phones to take a photo of

the check. And Bank of America last year introduced Erica, a chatbot accessible through its mobile app and the

online banking site. Erica helps users with tasks like searching through recent transactions, finding ATMs, and

scheduling bank appointments via text or voice commands. Bank of America has said there were more than a

million users within one month of Erica’s nationwide launch and reportedly six million users after nine months. In

a July 2018 Kantar survey, one month after Erica’s June launch, 9% of Bank of America customers had already

used the chatbot – and 95% rated the experience as successful. Capital One also offers a digital assistant

called Eno.

With consumers increasingly inseparable from their phones, it’s no surprise that banks are pushing mobile

services. Kantar’s continuous monitoring of consumer behavior traces the adoption of banking features and the

current state of the mobile banker. Although some consumers are hesitant to adopt mobile banking and

payments wholesale, many do not share these concerns – and rate access to mobile banking services as a

priority. Consumers are using mobile devices to check bank balances, apply for new credit cards, redeem

rewards, pay for things in store, and to send money to family and friends.

Using a mobile device to conduct banking business

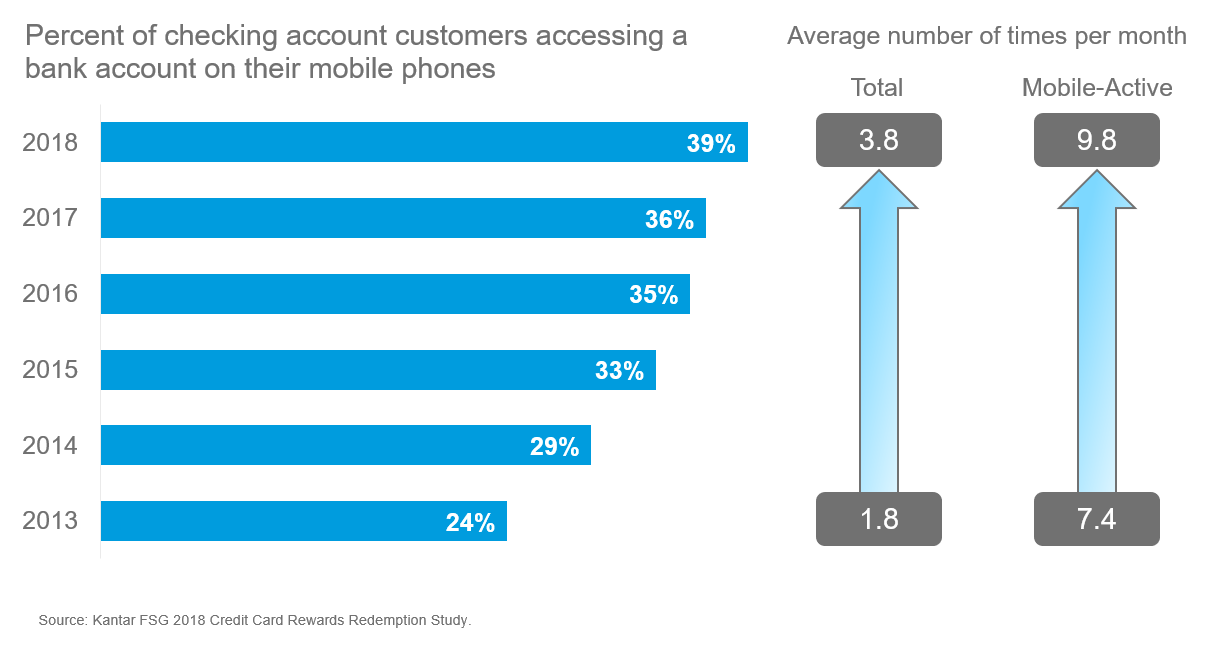

The number of checking account customers who have accessed a bank account via a mobile phone increased

from 24% in 2013 to 39% in 2018. As mobile account access has grown, so has the frequency of interactions,

rising from an average of 7.4 times per month in 2013 to 9.8 in 2018. Not surprisingly, these trends are even

more pronounced among younger consumers – two-thirds of Millennials check their bank accounts on their

phones, at an average of 11.5 times per month, as of 2018.

Applying for new credit cards on a mobile device

Two-thirds of US consumers who applied for a new credit card this year applied online – and of those, 20%

applied on their mobile phones.

- Mobile applicants skew younger – 28% of online applicants age 18-34 and 26% of age 35-49 applied on

their phones, compared to 16% of those age 50-64 and just 6% of those age 65 or older. - The mobile channel is also more appealing to new cardholders with lower credit – 33% of online applicants

with risk scores under 660 applied via a mobile phone, compared to 19% of those with scores of 660-719,

and 12% of those with scores of 720 or higher.

Redeeming rewards on a mobile device

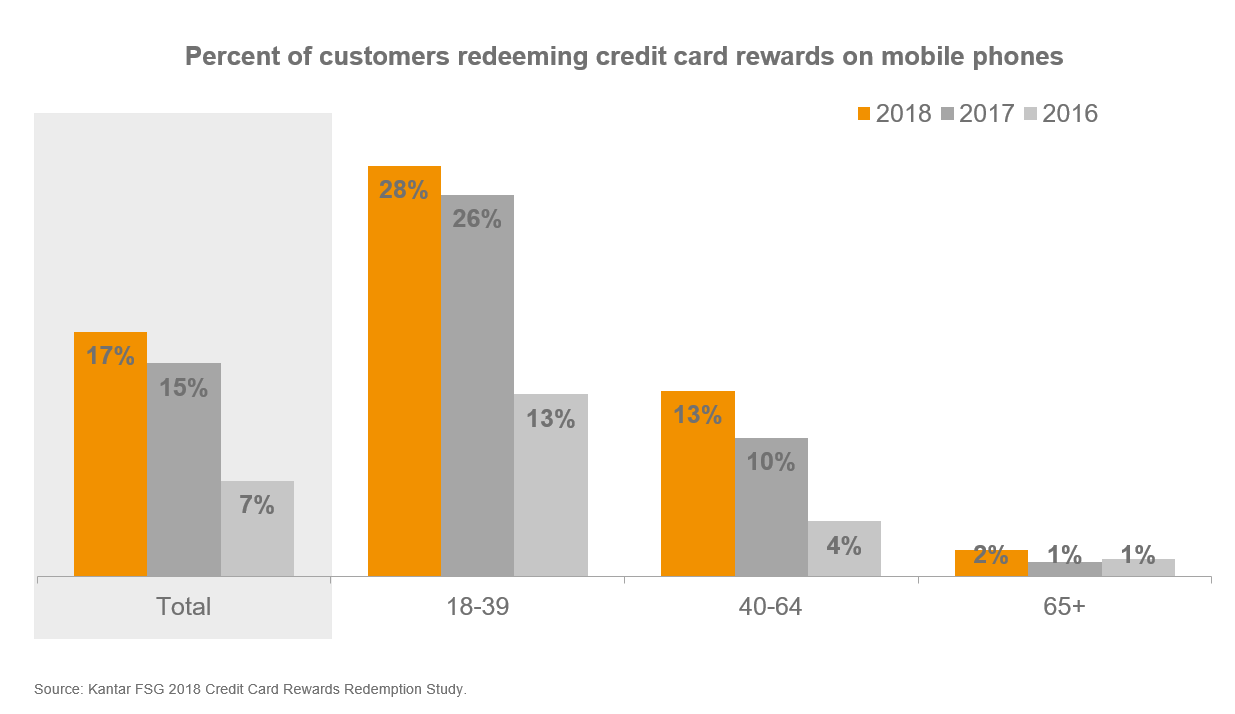

Once consumers are using their new cards, they’re also increasingly likely to redeem rewards on a mobile

device.

Nearly 20% of credit card reward redemptions were done on a mobile phone last year, according to Kantar data.

That’s up from 15% in 2017 and just 7% in 2016.

- Of that 17%, almost half said it was their first time redeeming on a phone, and most said they will likely use

mobile to redeem again. - Among the 83% who did not redeem rewards on a mobile device, more than 20% say they would redeem

more often if they could use mobile for redemptions – up from 15% two years ago. - Younger consumers are driving mobile redemptions, with over 25% redeeming their credit card rewards on a mobile device.

Mobile payments

Two-thirds of consumers with a smartphone say they use at least one type of mobile payment or digital wallet,

up from 35% three years ago. Speed and convenience are the top factors behind adoption of mobile payments.

A 2018 Kantar study found that 19% of smartphone owners are making in-store payments with their phones –

with mobile payments most popular, once again, among younger consumers who have fewer security concerns

about mobile transactions. Just 13% of younger consumers are not using any type of digital wallet, compared to

51% of those age 55 or older.

Sending money on a mobile device

Sending money directly from one person’s account to another’s (P2P payments) were popularized with the

introduction of the Venmo app. Two years ago, many banks started offering a competing P2P service, Zelle.

Both services allow money to be transferred to someone else’s account simply by entering the email address or

mobile phone number for the recipient.

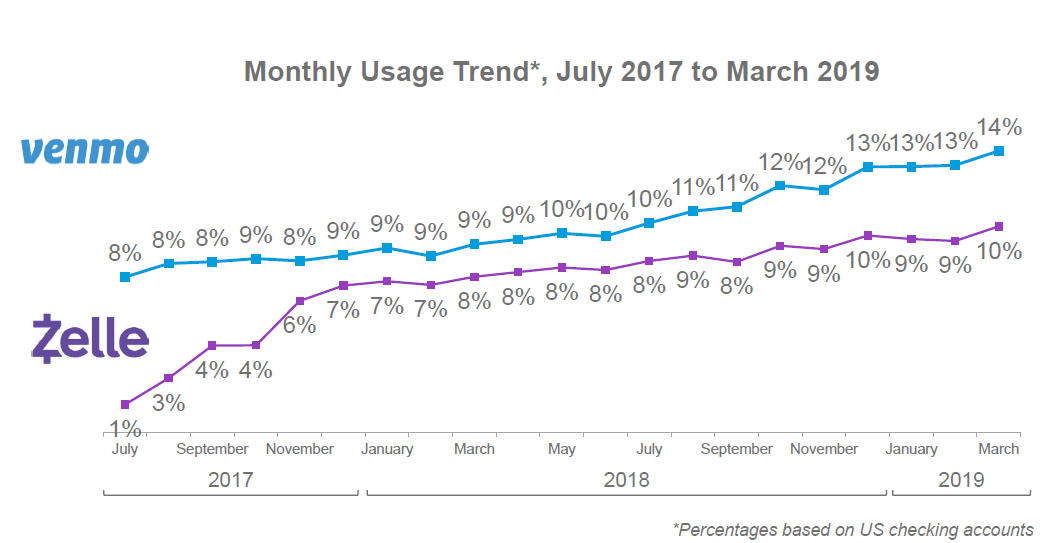

Kantar’s behavioral payments data shows that adoption and use of both Venmo and Zelle continue to grow.

Since its debut in mid-2017, the percent of checking accounts with any Zelle transactions has grown to about

10%, only slightly behind Venmo.

Users say they like Venmo and Zelle because they make it easy to split a restaurant check or to pay someone

back. They also say it means they don’t have to carry cash.

The mobile banking outlook

Not all activities are mobile-friendly. Although half of credit card rewards customers say redeeming their rewards

on a mobile phone is important, that enthusiasm dampens when it comes to more complicated redemptions like

travel bookings. Just 36% say they want to redeem for travel bookings using a mobile app. And half of

consumers who currently are not paying with a mobile device in stores say they’re not interested – primarily

because they worry about the security of their credit card information, don’t feel comfortable paying with a

mobile device, or simply prefer using their current payment methods. Similarly, two-thirds of consumers who

haven’t used P2P services simply don’t have a need for them, while one fourth worry about the security.

Despite these concerns, each year sees a growing number of consumers engaging in some mobile banking

activities. It’s no surprise that a seemingly perpetual attachment to smartphones has given rise to the mobile

banker. As with many smartphone applications, the earliest adopters of mobile banking and payments, as with

many smartphone applications, have been younger consumers. Millennials have shown a strong inclination in

recent Kantar studies for conducting all aspects of banking on a mobile device, ranging from checking on their

account balances to the more complicated transactions, including making purchases, applying for new cards,

and transferring funds. What’s more, many customers – not just younger consumers – rate having access to

banking features on their mobile phones a priority.

While selfie banking may not be coming to the United States any time soon, there are plenty of other mobile

features that banks and card issuers are continuing to test and offer. Mobile banking offers the promise of

increasing use and loyalty among less-active and under-banked customers, as well as the potential to speed up

application processes, reduce trips into a bank branch, and lowering customer service call volume. These are

promises that banks of all sizes are eager to capitalize on.