Rebecca Koppie

Research Analyst

Rebecca Koppie joined Kantar in 2012 as Research Analyst for their Boston-based Financial Services Group. In her role she is responsible for managing relationships across a broad portfolio of clients, and oversees ad hoc survey projects for multiple clients including project kick-off, survey design, programming, analysis and presentation. She is instrumental in the production of the Group’s popular syndicated reports, most notably as the lead developer and writer of the Cardholder Delinquency quarterly report, and recently managed the launch of the Group’s auto insurance tracking panel. In 2015, Rebecca was elected to Kantar’s 2016 Americas’ Advisory Council. She is also member of the ESOMAR CYP program (Corporate Young Professionals) and in that role she attended the ESOMAR Congress.

Prior to joining Kantar, Rebecca was a Senior Data Advisor for Forrester Research.

Rebecca has a master’s degree in communications management from Simmons College and a bachelor’s degree in marketing from Stonehill College.

This article was first published by Admap Magazine in August 2019

A “selfie” can now open a bank account.

In some places, anyway. In June, Natwest, part of the Royal Bank of Scotland, became the first major UK bank

to allow customers to quickly open a new bank account – without visiting a bank branch – by uploading

documents and submitting a selfie on their mobile device. This continues a trend set by several banks in other

regions, including the Philippines and South Africa. In the United States, reports of the advent of “selfie banking”

were abundant in 2016 and 2017, but so far it is not an option.

Read More

Topics:

Mobile Banking,

Financial Services,

Marketing Research Data,

Consumer Insights,

thought leadership,

behavioral data

Kantar takes a deep dive into 5% rotating category rewards programs. We explore how effective quarterly promotions are in generating transactions for the top players – and how these leading category cards may be impacting competitors.

Read More

Topics:

Financial Services,

behavioral data

The Lightspeed Financial Services Group (FSG) recently reported on consumer trends and reactions regarding data breaches, personal loans and credit card acquisitions, and we now turn to credit card comparison shopping. In our latest post, we explore how digital marketing is more important today in establishing awareness, but digital tools also make it easier for prospective cardholders to compare multiple cards.

Read More

Topics:

Data Driven Marketing,

Financial Services,

marketing research trends

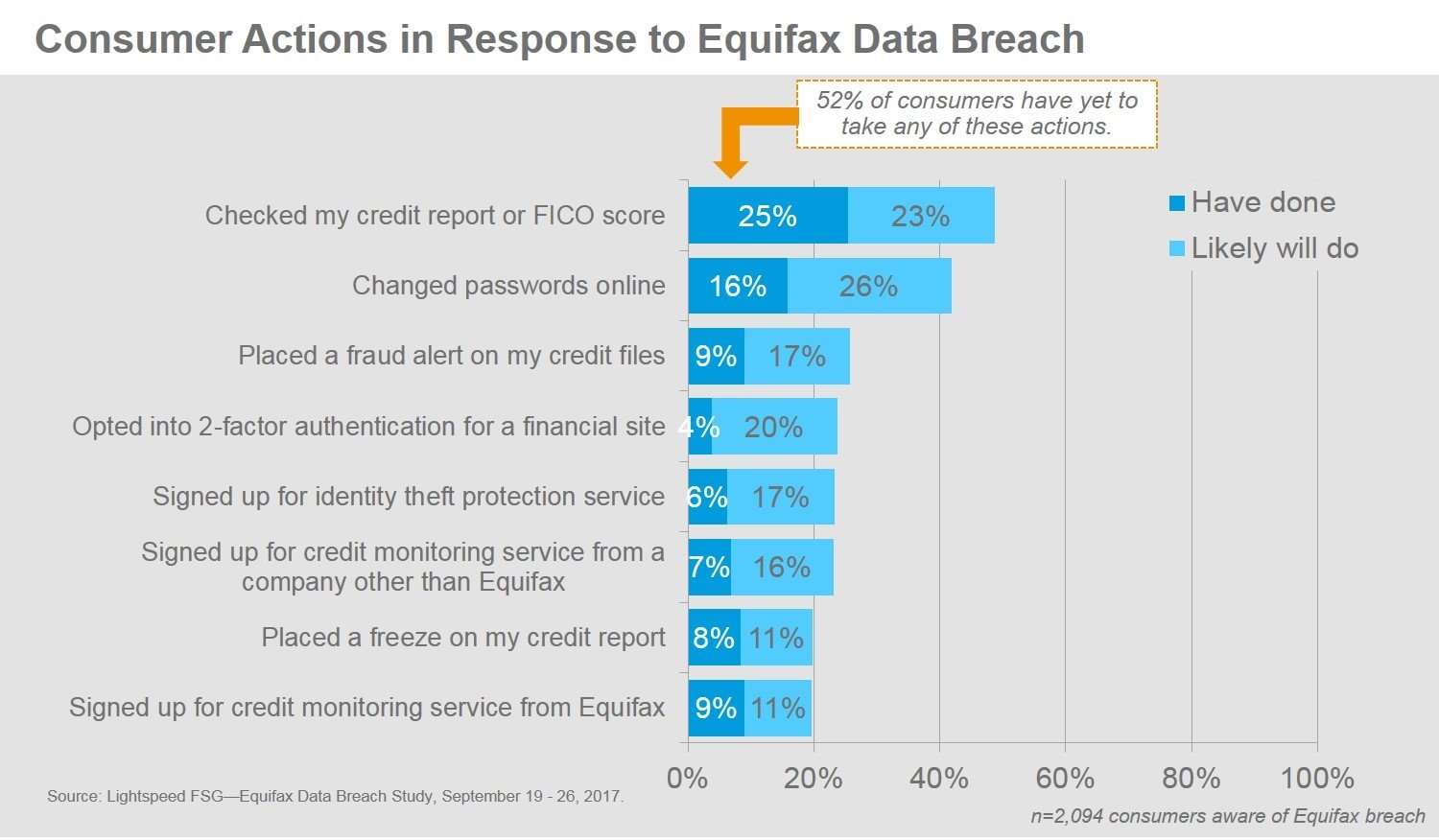

While more than 80% of US consumers are aware of the Equifax data breach announced this month, relatively few have taken actions beyond checking their credit card transactions a little more closely, a new Lightspeed survey reveals. But they want assurances of monitoring from their banks and credit card companies.

Read More

Topics:

Financial Services,

Data Breach

What does personal loan usage look like among your customer segments or within your footprint? In the latest Lightspeed Financial Services Group post, we look at consumer trends across secured and unsecured loans.

Read More

Topics:

Data Driven Marketing,

Market Research Trends,

Financial Services

Our Lightspeed Financial Services Group series continues with another look at credit cards. Consumers prefer a stable rate when it comes to rewards programs, but what do people feel about signing up for a new card all together? In our latest post, we learn what appeals to new card holders.

62% of new cardholders say applying for their new cards didn’t impact the usage of other cards in their wallets – but 38% did cancel or stop using another card, according to Lightspeed FSG’s 2017 New Card Acquisition Study.

Read More

Topics:

Financial Services

Our four-part series from Lightspeed Financial Services Group continues with a look at credit card reward programs. Our first post highlighted consumers' views of daily dangerous driving activities, demonstrating how mobile enables risky behavior. Today, we focus on what rewards programs appeal to consumers and how the branded competition stacks up.

Read More

Topics:

Financial Services,

Marketing Research

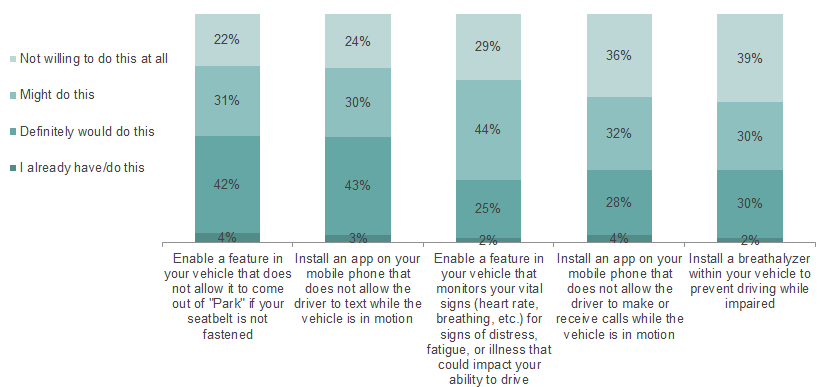

While many consumers agree that using mobile phones while driving isn’t OK to do, the activity is perceived as only moderately dangerous compared to other distracted driving activities. According to a recent Lightspeed FSG study on Dangerous Driving Activities (2016), 45% of U.S. consumers agree completely that it’s never OK to use a mobile phone while driving (65% agree completely or slightly). More than half of respondents observed other drives using their phones while driving. And, older consumers are more likely to agree with this sentiment than younger consumers (37% of 25-34 year olds vs. 59% of those age 65+).

Read More

Topics:

Lightspeed FSG

New Orleans Jazz represents a mix of individualism and cooperation - a merger of tradition and progress. It has an emotionally-evocative sound, with the ability to express a full range of sentiments reflecting the city’s rich and sometimes difficult history.

I recently attended ESOMAR Congress as a Corporate Young Professional representative from LiGHTSPEED. Peppered throughout the conference were the sounds and tastes of New Orleans, giving the global market research audience in attendance a sense of New Orleans culture and history while we learned about market research being conducted across the world. One such “sound” was keynote speaker Dr. Michael White, an acclaimed jazz musician and historian. I encourage you to check out some of his work here.

Read More

Topics:

Market Research,

esomar